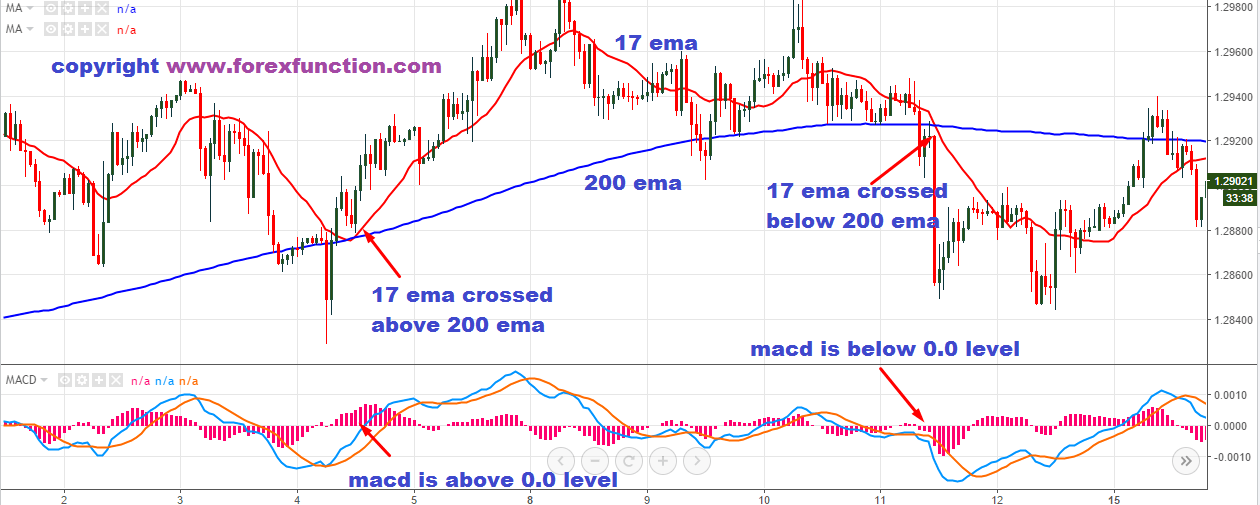

This is most commonly some type of support and resistance. My favourite way, and the most common way to trade the 200 EMA in forex markets is to combine it with another form of price action confluence. Using The 200 EMA With Support And Resistance If we were trending below the 200 EMA, we would be looking for selling opportunities instead. We can assume that the price is going to continue to the upside, until the 200 EMA is broken. The trend is confirmed by the fact the price is above the 200 EMA. On USDJPY daily chart, we can see a bullish trend. This is as simple as it sounds and forms the bedrock of a lot of traders bias! One way to use the 200 EMA in your forex trading is to use it as a directional bias. Let’s take a look at the 3 ways I personally use in my trading… 1. There are multiple ways to use the 200 EMA in your forex trading strategies. This is in no way bulletproof but it can certainly help to avoid getting caught on the wrong side of a trending market.Īs you can see in this example, looking for short trades on EURUSD 4H as price was trading below the 200 EMA would have given you an edge in the market.

200 EMA STRATEGY HOW TO

We recommend that you contact a personal financial advisor before carrying out specific transactions and investments. Any action you take on the information in this video is strictly at your own risk.

200 EMA STRATEGY PROFESSIONAL

This content is for educational purposes only, and is not tax, legal, financial or professional advice. I assume no responsibility or liability for any errors or omissions in the content of this channel.

Take all of my videos as my own opinion, as entertainment, and at your own risk. RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. ▶ How to Trade With Indicators | Best Trading Indicators For Forex & Stock Market ▶ Price Action Trading Strategies For Beginners | How To Trade Without Indicators ▶ Day Trading Strategies | Best Way To Day Trade CFDs, Stocks And Forex ▶ Scalping Trading Strategies | Short Term Forex & Stock Trading ▶ Smart Money Trading Strategies & How To Trade Like Banks ✅ Trade Directly In TradingView With BlackBull Markets:

200 EMA STRATEGY FULL

Our full 200 EMA trading strategy to trade stocks, Forex & indices.How to use confluence to find the best scalping and day trading signals.How to trade like a professional trader on using confluence.Confluence trading is when there is more than one signal, coming together at the same point in the market.ĭiscover a secret trading strategy to day trade and swing trade, using key price levels and the 200 exponential moving average (200 EMA).

0 kommentar(er)

0 kommentar(er)